Everyone wants to have "smart beta", but it is not clear what is the agreed definition for this concept. One of the simplest definitions is using a different weighting mix than market capitalization. The standard benchmark used is a market capitalization index, so if you re-weight the index based on another risk factor you can have a different risk-return trade-off relative to the standard index. Is that smart or just different? You create a different beta and a different sensitivity to the market portfolio.

The standard approach of market capitalization does have some drawbacks. It will overweight expensive stocks and underweight cheap stocks. It will see increasing weight to those stocks that have higher momentum.

There may not be a clear definition of smart beta but the money management industry is adjusting to the fact that simple alpha and beta is not enough to satisfy investors who want cheap customization.

The standard approach of market capitalization does have some drawbacks. It will overweight expensive stocks and underweight cheap stocks. It will see increasing weight to those stocks that have higher momentum.

You are switching risk factors for what you may perceive as a long-term advantage, but as more money pours into these new standards, the value-added may actually disappear. Any risk premium is likely to be diminished as more money is committed. Additionally, if you tilt to factors other than market capitalization you are just changing exposure to the main 3-factor model of Fama-French. You may have more small cap effect or more value.

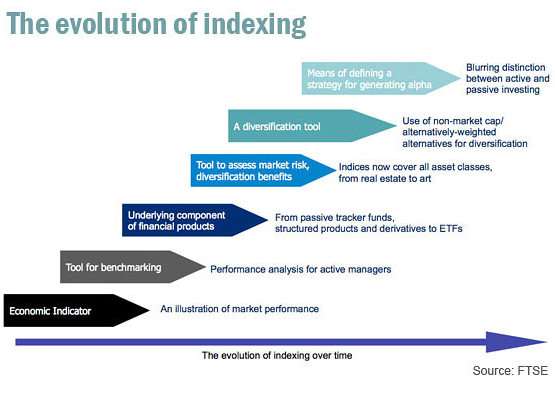

Nevertheless, it is good to look at what has been going on in money management with respect to the concept of smart beta. Clearly there has been an evolution of the concept of beta from a simple sensitivity to the market portfolio in the 80's to more complex concepts. We have moved from thinking of the world in just alpha beta space to a broader breakdown.

With the changing concept of beta has been an evoalution of indexing. There are wide range of indices which can provide smart beta or exposure to any market factor or asset class.

The smart beta concept is a combination of passive and active strategies within a structured set of rules. If you want a "passive" portfolio based on sales growth or size, it can be created. You just need a set of rules.

This mixing of passive and active investing has blurred the services provided by money managers. The industry can breakdown different types of beta as well as different types of alpha.

The growing complexity of alpha and beta has to be matched against the rising complexity of investor priorities

There may not be a clear definition of smart beta but the money management industry is adjusting to the fact that simple alpha and beta is not enough to satisfy investors who want cheap customization.

No comments:

Post a Comment