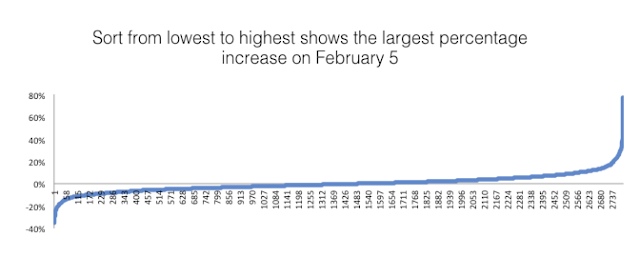

The size of the move in the VIX index was large. The market is at the highest VIX level in years. We have to go back to 2015 to see this level. On a percentage basis, the change in the VIX was the single greatest increase over the last eleven years we looked at for comparison. It was a 77% increase from the previous day and more than 50% higher than the next greatest one-day increase. Sorting the percentage changes gives another look at magnitude of the change. This was a historic day for volatility.

"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Monday, February 5, 2018

VIX index move was historic - The impact will be a negative feedback loop leading to equity selling from volatility rebalancing

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment